LEDs Poised to Outshine All Others in $4.4B Lighting Market

<p>Philips, Osram Sylvania, and GlacialTech Inc. are among the firms recently introducing products for an LED market that's expected soar in the next decade. New research forecasts that LEDs will account for almost half of a $4.4 billion market for lamps in the commercial, industrial and outdoor stationary sectors by 2020 -- and the rivalry is heating up among lighting companies trying capture the lion's share of the business.</p>

Dutch giant Royal Philips Electronics took the wraps off its 12-watt EnduraLED light bulb last week at the Lightfair International tradeshow and heralded the latest addition to its EnduraLED line as the "industry’s first" light emitting diodes replacement for the commonly used 60-watt incandescent light bulb, bringing a new measure of energy efficiency to everyday lighting applications at work and in the home.

Osram Sylvania, a subsidiary of Geman powerhouse Siemens AG, countered the following day with its alternative. It introduced attendees at the tradeshow in Las Vegas to the dimmable, mercury-free Sylvania ULTRA LED A-line 12-watt bulb, which its maker calls "the brightest LED replacement" for the traditional 60-watt bulb.

Taiwan-based GlacialTech Inc., a diversified manufacturing firm specializing in cooling, power and lighting, debuted LED products in announcements bracketing Taiwan's International Lighting Show in March and the Lightfair expo. GlacialTech's new offerings include a 19-watt portable LED outdoor floodlight and low-power T8 LED tubes.

Taiwan-based GlacialTech Inc., a diversified manufacturing firm specializing in cooling, power and lighting, debuted LED products in announcements bracketing Taiwan's International Lighting Show in March and the Lightfair expo. GlacialTech's new offerings include a 19-watt portable LED outdoor floodlight and low-power T8 LED tubes.

With a U.S. mandate for more energy efficient lighting taking effect in 2012 and more businesses looking for ways to cut electricity costs, LEDs represent a burgeoning market for the lighting industry -- and the rivalry is heating up among companies that want to seize the lion's share of the sizable spoils.

{related_content}A new study from Pike Research forecasts that LEDs will account for almost half of a $4.4 billion market for lamps in the commercial, industrial and outdoor stationary sectors by 2020.

Almost 18 percent of global electricity use goes toward lighting, and lighting in the U.S. consumes a fifth of the amount at an annual cost of more than $40 billion. With their ability to produce the same amount of light as traditional bulbs while consuming less energy and lasting far longer, LEDs represent a strong opportunity to cut expenses and reduce electricity use.

Typically, the LED replacements for traditional bulbs are described by their manufacturers as delivering 80 percent energy savings and lasting 25,000 hours, which can be 12 to 25 times longer than the bulbs they are replacing, depending on wattage and the company doing the talking.

Widely used for traffic signals and exit signs, LEDs have yet to break through the cost barrier, which has been the biggest obstacle to market penetration. But that's expected to change.

Prospective price tags have been reported in the range of $60 for LED retrofits for incandescent 60-watt bulbs and $40 to $50 for LEDs that replace 40-watt bulbs. However, some companies are saying they can beat those prices, at least one already is, and all the firms are jockeying to be the best, brightest and "first" in a number of descriptive categories.

For example, among the recently announced products:

The new, dimmable Philips EnduraLED will save businesses and households buying it about $120 per lamp because of its long life and energy efficiency, the company said, adding it expects to have the product on store shelves sometime in the final quarter of the year.

With plans to go to market in August, Osram Sylvania said its ULTRA LED A-line 12-watt bulb will be brighter than its rivals. It's also expected to be cheaper than the competition -- though the company isn't discussing pricing publicly for now. Sylvania said it will release a 75-watt retrofit LED lamp in 2011 and then, staking a claim for another "first" title, declared that its announcement marked the first discussion about creating such a product.

Those products join a field that includes:

Panasonic's LED alternative to the 60-watt incandescent bulb. The replacement bulb is one of eight in the EVERLEDS line. They were announced in September 2009 and made available the following month in Japan. Demand for LEDs is so high, Panasonic Electronic Works said in March that it is expanding the product line to 1,100 items by March 2011.

General Electric's 9-watt LED replacement for 40-watt incandescent bulbs. The new bulb, part of GE's Energy Smart line, is due out later this year with a price ranging from $40 to $50.

The Home Depot also has entered the fray with the EcoSmart LED A19 40-watt equivalent light bulb, which has an online price tag of a wallet-friendly $19.97.

The introduction of other products and advancements in technology are expected to help fuel the growth of LEDs in the lighting market. In addition to bulbs, developments in LED fixtures and systems, such as the networking platform introduced by Redwood Systems in March and launched at Lightfair, are occurring with greater frequency.

“LED lighting will reach an inflection point in the next five years,” Pike Research Managing Director Clint Wheelock said in a prepared statement about his study. “As solid state lighting costs come down and performance increases, LEDs will become a practical option for an increasing number of commercial applications.” Pike projects that outdoor stationary will be the next growth sector for LEDs with retail, office and professional buildings and institutional facilities following.

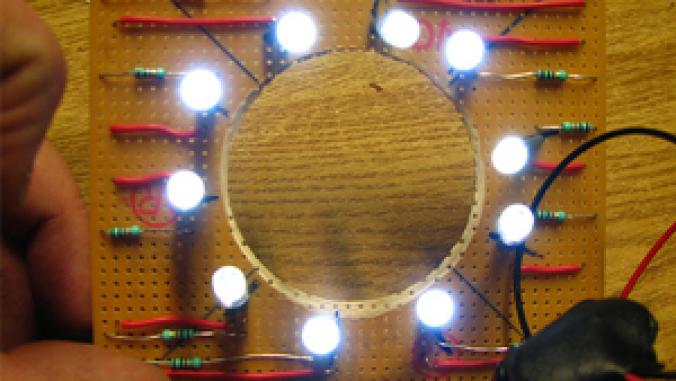

Top image -- Philips Lighting CEO Rudy Provoost shows off his company's LED replacements for traditional 60-watt bulbs, courtesy of Philips. Inset images courtesy of product manufacturers: Philips, Osram Sylvania, GlacialTech Inc., Panasonic, GE and the Home Depot.